SWISS MORTGAGES RATES FORECAST 2024

Get your chequebook ready, the best time to buy Swiss property is imminent

Have you been looking for a Swiss home to buy over the last few years, but the interest rates have put you off? Well, it is looking increasingly likely that Swiss mortgage rates are going down. The next question becomes – how soon can you find a home before the lower rates drive property prices higher?

Swiss mortgage rates were set at historically low levels from January 2015, when the SNB (Swiss National Bank) dropped the exchange rate protection set at 1.2 between the Swiss Franc and the Euro.

Until this point, the SNB had fervently defended this exchange rate in order to protect the Swiss economy; a strong Franc means more expensive exports, which negatively impacts the Swiss economy, from finance to pharma.

After yielding to markets, and giving up the exchange rate peg, the SNB artificially weakened the Swiss Franc by dropping the Swiss base interest rate to an unprecedented -0.75%. Subsequently, Swiss mortgage rates plummeted; it was possible to get a 15-year fixed mortgage for 0.75%. This author – among others – was vocal in pointing out that the cost of repayments on a home were actually far less than the cost of rent for the very same property.

Fast-forward to 2020, and whilst the general populace had by now cottoned-on to this fact, the fear of covid pandemic-induced job losses lead many to believe that Swiss property prices would crash. As this author pointed out at the time, the opposite turned out to be true – Swiss property prices rose dramatically, not least of which fueled by low interest rates, increased money supply, and the need to get out of cash due to high inflation.

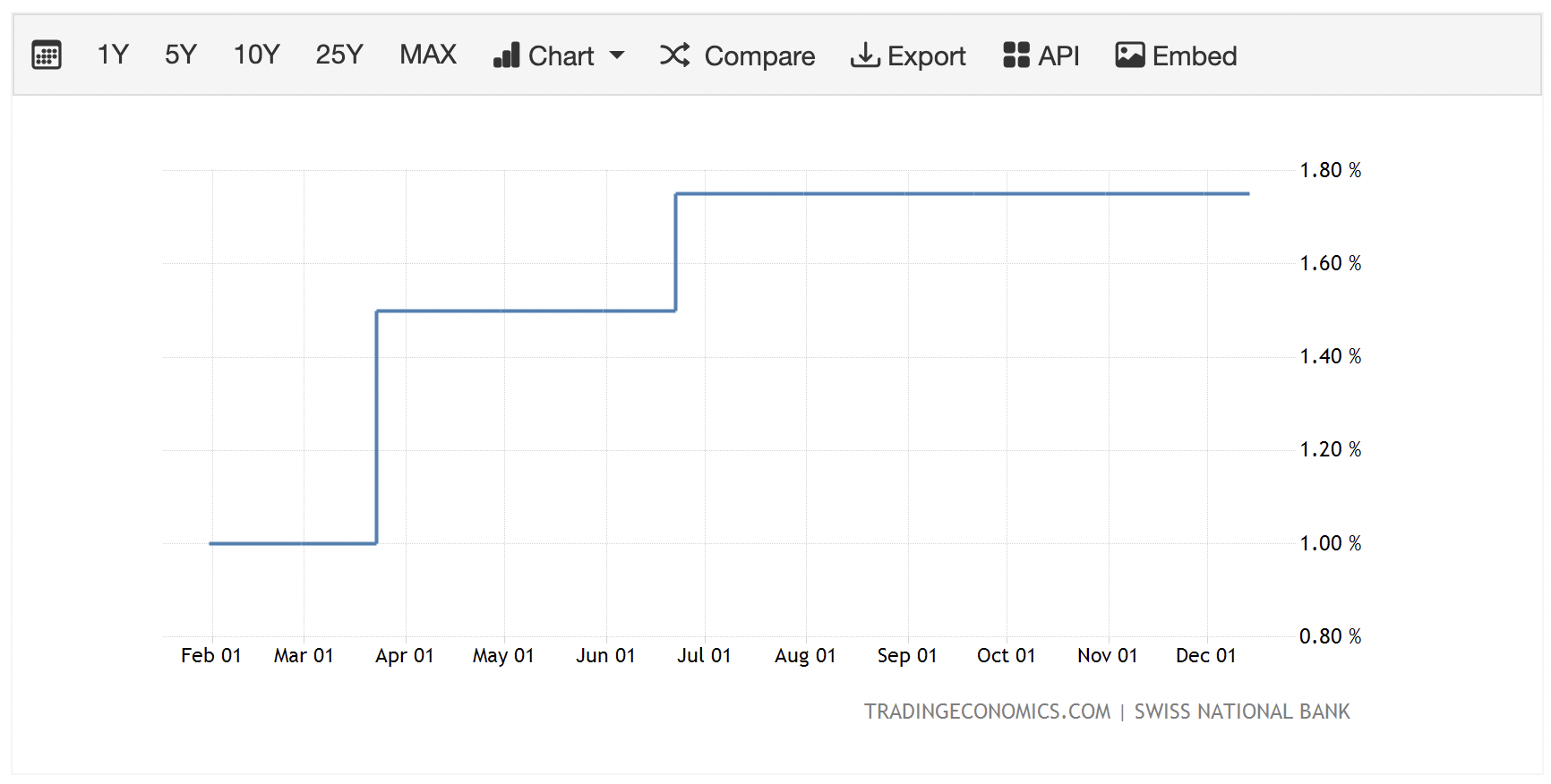

As a consequence, the SNB successively increased the base rate, reaching and then staying at 1.75% since June 2023. Naturally, this is uncomfortable for the Swiss economy, and therefore the SNB (although the extra purchasing power abroad is welcome for Swiss residents).

We therefore reach a point where the SNB is looking to decrease the Swiss base rate as soon as possible. What can trigger such a move? Falling inflation, economic contraction, increasing unemployment, and/or the country’s main trading partner dropping their interest rates.

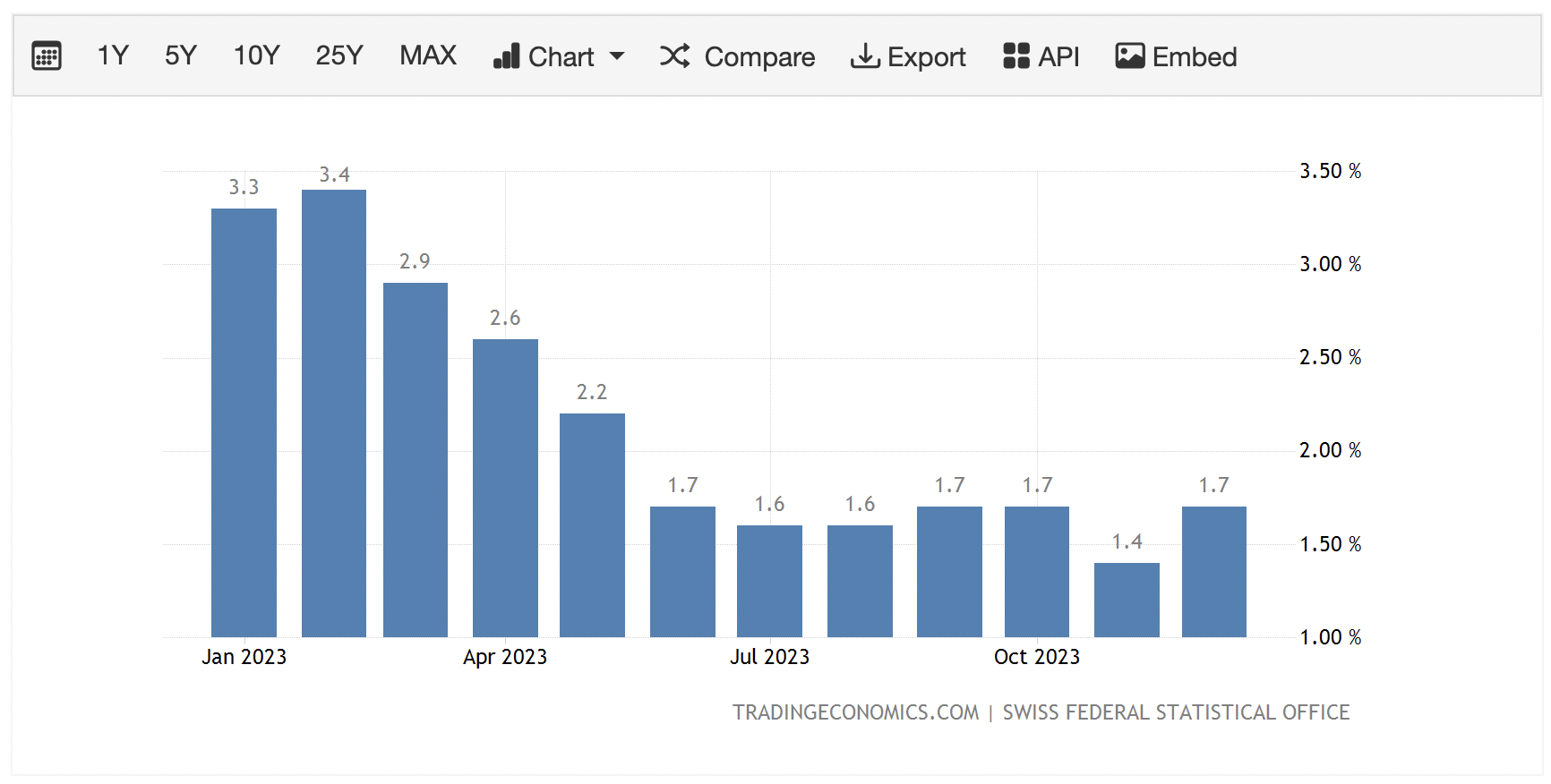

As of today, inflation has plummeted from its high of 3.4% in February 2023 to just 1.7%.

According to Bloomberg, president of the ECB Christine Legarde, on Wednesday January 17th 2024, stated that it’s likely that the ECB will start cutting rates in the Eurozone from the summer.

The 10-year fixed mortgage rate in Switzerland has already dropped from an average of 2.35% in 2023, to 1.85% in January 2024. How much lower will it go? No one knows, but what we do know is the difference that this small percentage change represents when the average mortgage size is one of the highest in Europe, if not the world:

CHF 1,000,000 mortgage loan (hypothek/hypotheque)

10-year fixed rate:

- 2.35% interest = 23,500 annual repayment

- 1.85% interest = 18,500 annual repayment

- 1.35% interest = 13,500 annual repayment

At IWP, we specialize in helping our clients ascertain whether a home purchase makes sense versus renting, how best to structure a Swiss property loan, and we can access every mortgage provider in Switzerland to provide a comparison of the best mortgage rates to get you the best deal possible.

There are many factors to consider when purchasing a home in Switzerland, such as whether to use your Swiss pensions to buy a home, Swiss property taxes, and how long you plan to live in Switzerland. However, with qualified advice from a Swiss-regulated independent adviser, such questions have answers.

Click HERE to contact us Today

Disclosure:

This article has not been written to give advice, and purely expresses our own opinions. We are not receiving any compensation for it, and we are not responsible or liable in our capacity as an independent financial adviser for any action taken by readers based on these opinions. For personalised advice based on these issues, please seek advice from a regulated, independent expert.